Before start, it’s worth just asking yourself some soul-searching questions. Don’t skip this bit. Take a few minutes to note down the answers to yourself. There is no ‘right’ or ‘wrong’ answer, but you need to be true to yourself. You need to know why you’re doing something. Why do you want to start freelance bookkeeping? Whatsmore, why a ‘bookkeeping’ job in particular? Do you know what it requires to get freelance bookkeeping jobs?

This is important. We’re going to go into the ‘hows’ of starting shortly – don’t worry about that – we’ll get there. But there is a saying – knowing your ‘how’ will come. How do you start your virtual bookkeeping job? Okay, today I will give you all the necessary things you need to get freelance bookkeeping jobs. Let’s get started with the duties of a bookkeeper.

Responsibilities for Freelance Bookkeeping

The duties vary from employer to employer. There are plenty of work options, so you need to be ready for doing as your employer required. I will show you some possible responsibilities below:

You will be responsible for;

- Maintenance of fund cashbooks, including daily conciliations of fund cash movements and the division of principal and interest.

- Monthly balance sheet maintenance and reconciliations

- Assisting with payroll processing

- Assisting with merging multiple acquired ledgers on to SAGE

- Working with the administrator to make sure all purchase receipts are properly recorded and paid on time.

- Supporting asset fundings and repayments, helping to ensure key procedures ensue.

- Maintenance and adjustment of debt facilities on the loan book system.

- Supporting the maintenance of fund & asset documentation in accordance with firm procedures.

- Maintaining the forecasting of fund cash issues.

- Maintaining the improvements and distributions process in accordance with fund contracts, reviewing the work of the administrator.

- Assisting with the production and distribution of Investor reporting.

- Monitoring the administrator’s processing of KYC/AML in respect of incoming/outgoing investors.

- Uploading documents to the Investor Portal and ensuring contact and distribution lists are kept up to date.

- Assisting the Financial Controllers and administrator in the production of calls and distributions notices.

- Supporting the Financial Controllers in monitoring principal and interest transactions impacting the portfolios

- Assisting finance team

Types of Work from Home Bookkeeping

There are two different options for you to work from home as a freelance bookkeeper, either working for a company that provides bookkeeping service or directly working for the company itself.

You can work in two ways, if you are working for the company that provides bookkeeping services, you might have several different clients but you might not make as much money because there is a middleman. The best thing about this kind of job is that the company will bring the work to you.

Finding Remote Bookkeeping Jobs

You need to search at-home job on popular job sites. You can get a job by finding a traditional bookkeeping job. You can have a perfect remote work with finding a traditional job then transitioning it to being home-based.

[su_button url=”https://prime.adamsacademy.com/course/career-in-accounting-bookkeeping-and-payroll-management-diploma/” target=”blank” background=”#29cbf5″ size=”6″ center=”yes” radius=”round” icon=”icon: arrow-right” text_shadow=”0px 0px 0px #000000″]Career in Accounting, Bookkeeping and Payroll Management Diploma[/su_button]

Just look around you, many of your friends doing the at-home job by this process. It might be best if you apply for a few bookkeeping jobs in your area and seek the perfect one that can be converted to a remote one. You can use this approach with smaller companies with fewer policy bindings, this can bring your best of your luck. I suggest you be strategic when you are applying for the jobs, consider a smaller one instead of a large company so that you can get the flexibility.

One of the best practices for a remote job is searching on workplace such as Upwork, Fiverr, Flexjob, you might get exactly what you are looking for. It is worth checking out.

Best Freelance Bookkeeping Job Sites

I break down a list for you, it will help you to find out your virtual bookkeeping or remote bookkeeping jobs.

You can go there, it is the top site for remote freelance bookkeeping jobs.

Bookkeepers who are looking for traditional, nine-to-five jobs.

Bookkeepers who are looking for full or part-time jobs. You will find lots of option there.

Flex means flexible, this is a site for those who need flexibility in the work.

Those who are looking for a project or who want to work freely.

Freelance bookkeepers who want a more global client roster.

Bookkeepers who are looking to break into the entertainment business.

Those who want a quick start and less competition comparing others.

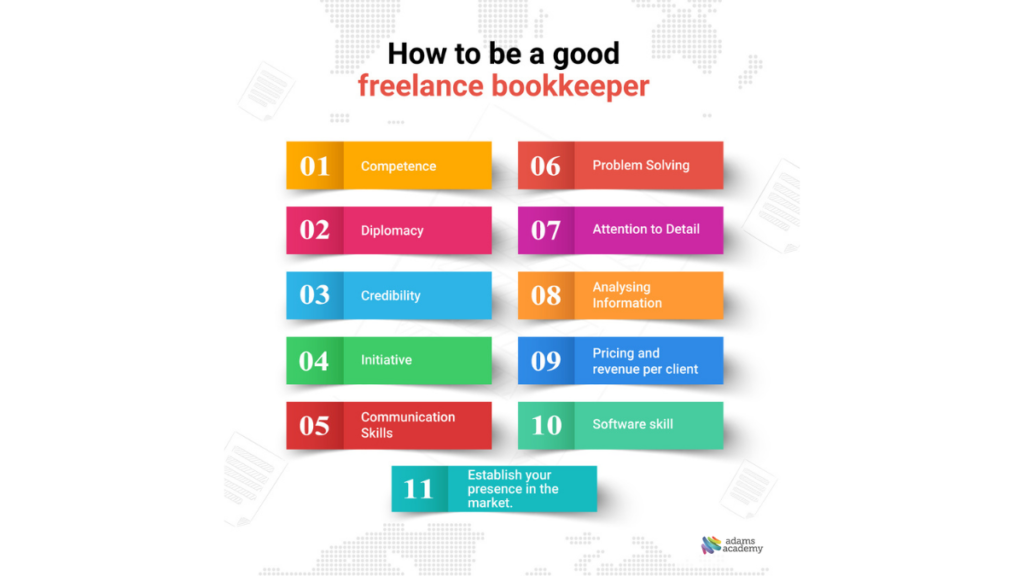

How to be a good Freelance Bookkeeper

Bookkeeping is a skill. It is a skill that can be learned, but it’s still a skill. Let’s take a look at how you can be a good Freelance bookkeeper:

Competence

Some jobs are fairly straightforward. The client is quite organised and you can cope. Other jobs may be more complex such as where job costings and other management information are needed by the board and there are strict deadlines – you may start to feel the pressure. This is where your background bookkeeping knowledge comes into play. Or (worse still), you could receive a complete and utter mess. Meaning you have to go back over someone else’s transactions, figure out what they did, and then fix it.

Diplomacy

So you do need to have that basic technical competence in your chosen subject: bookkeeping combined with a pleasing ‘people’ personality. At the end of the day – you are working with people, and you’re working quite closely with people because you’re dealing with their ins and outs. There’ll be bank statements you’ll see, that not even your clients’ spouse has seen! We’re talking personal here. You might even see the receipts for items that are their personal things. You need to have a pleasant way of dealing with people. Be diplomatic.

Credibility

The other core minimum needed to do the job of this type – is credibility. And by credibility, you ideally have to be solvent & presentable. In being self-employed, the first thing people need to buy into is you. You need to look like, sound like and act like you know what you’re doing. If you don’t come across in this way, you will fail. In being credible, it means people take you seriously. You need to have good communication skills, and you need to be able to explain to a client, in their own language, what’s going on in their business, and give them some tips to help.

Initiative

When you work for yourself, you do need to have some initiative. There will invariably be situations that you find yourself in, which will require you to think quickly. So you need to have initiative and be self-confident. If you don’t have an answer, you need to know where you can go to get it.

Communication Skills

Talking in slang, poor verbal skills, bad written communication will all serve against you in this game. Even if you know every last thing there is to know about bookkeeping, if you come across as being illiterate or poorly educated, then clients won’t trust you with their work. They just won’t believe that you are capable. So, improve your communication skills.

Problem Solving

Very often, as a bookkeeper, you’re only drafted into an assignment because things are critical. It’s got so bad, that the client has broken down; they’ve conceded that they have to spend some money on fixing their books, and you’ve been called in. So, what the client wants, is someone with a ‘can-do’ attitude who can solve their issues, not create them. For this, you need a bit of initiative, imagination, critical thinking – and you need to be the type of person who can solve things.

Attention to Detail

I can’t help but spot things that are odd, or which don’t quite look right. I’m good like that. And it’s useful because in bookkeeping you need to be precise with attention to the smaller details. Often clients are relying on you to pick these things up for them. It’s always worrying for a client, if they’ve spotted an error, and you haven’t. It then makes them wonder if you are any good, and whether they should just be doing the job themselves or get someone else in because you are supposed to be the expert in this field – not them.

Analysing Information

Clients like it when you take a keen interest in their business and understand how it operates. If you can understand what they do, then you might be able to suggest better ways of working. And if you have good analytical skills – you’ll be a good freelance bookkeeper.

Pricing and revenue per client

This can be an interesting one because there are all sorts of theories about price setting. The key thing is to understand the market and to understand what services you have on offer. How do you want to charge? In the UK, the financial year ending the 5th of April can often be a busy time for people offering accountancy related services. Will your prices change accordingly with the tax year? Will you have a flat rate price per hour, or ‘fixed’ per task within a limit.

Establish your presence in the market:

More you advertise your existence more you get options, build your digital presence by using:

Every social media like- Facebook, Twitter, Google+, Tumbler etc

- Create your own website

- Follow SEO strategy and write blogs

- Get into content marketing

- Create a simple email newsletter

- Don’t forget about traditional marketing

- create advocacy that is the word of mouth marketing

- Join networking events and

- Contact people in your network

Software skill

It’s all very well knowing your manual entries – I think this stands you in very good stead, but what if a client came to you and said, “I use Sage, and I need these 6 items entering onto the system” would you be able to manage it? On Sage, where would you go to enter these transactions?

What if they were using QuickBooks? Would you know how to enter these transactions onto the system? Sometimes we may think we know how to use a software package, but all we know is how to put on the simple, straightforward things. I’ve seen bookkeepers struggle because the client has paid for something using their personal credit card, and they don’t know how to enter it onto the system. The worst thing about being a freelance independent bookkeeper is that often, you need to know. There’s no-one else to ask because it’s your job to know! The worst thing about being a freelance independent bookkeeper is that often, you need to know. There’s no-one else to ask because it’s your job to know!

Quickest Way to Get Qualified for Freelance Bookkeeping Jobs

You can do a simple level one bookkeeping certificate at your local college. If you enjoy it, you can always do level two or take it a step further, and go for a full-one qualification. The AAT (Association of Accounting Technicians) have an NVQ (National Vocational Qualification) level two, three and four – each level taking you further into the subject material. And after that, you could do a degree in accounting. The level one in basic bookkeeping is the quickest option, e.g. 12 weeks. The degree took 3 years. But the AAT was the most practical and useful qualification.

There are different skills academies which give training and certification in accountancy and bookkeeping. Online learning or qualification is the quickest one. Take a look at here.

[su_button url=”https://prime.adamsacademy.com/course/career-in-accounting-bookkeeping-and-payroll-management-diploma/” target=”blank” style=”3d” background=”#29cbf5″ size=”6″ center=”yes” radius=”round” icon=”icon: arrow-right”]Get Your Diploma in Bookkeeping & Payroll Management Today! [/su_button]